Is Social Media Responsible for your Declining Funds?

Do you have friends who keep documenting their day-to-day activities on social media? Sure, you do. But have you ever imagined what their life actually looks like behind the camera? Remember my friend – the grass isn’t always green and no one posts their failures and struggles on the gram.

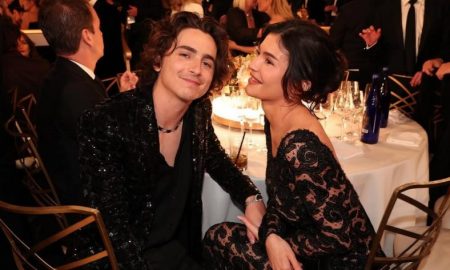

Andrea Piacquadio/Unsplash | People often maintain very artificial social media lives, something that can easily push you into an unnecessary competition in terms of overspending

Speaking of struggles, probably one of the saddest aspects of social media is the strain it puts on your finances. More than one-third of America’s young population admits the fact that social media has insanely influenced their spending habits. In fact, a recent survey driven by Mint shows legitimate concerns of teenagers wondering how their friends can afford such a glamorous and lavish lifestyle!

Brent Weiss, co-founder of a financial advisory firm states that if you have to compete with an entire social media group, you have to give up on a huge chunk of your money. Don’t believe that? Well, read on to get your dose of a reality check.

Try looking through the lens

It’s so easy to believe that Instagram and Facebook are telling the whole story. Hop onto any influencer’s social media account and you’ll always find a trail of posts that are far from reality or presented in a way that seems nearly impossible.

Lisa/Unsplash | Most social media influencers maintain a feed that looks very far from reality

Weiss states the moment you open the application, everyone is having a grand $50,000 wedding; everyone’s buying a new car or a lavish home. What they don’t tell you is what smart and informed choices they’re making to make all that happen. It doesn’t matter if they’re living their lives to the fullest; what matters is that they’re also balancing it with the rest of the important things.

We as human beings tend to make some of the worst decisions of our lives under the influence of a third-party or while experiencing different emotions. As such, it’s only natural for a distorted image of someone else’s finances to make you feel extremely insecure.

But at a time like that, you must always remind yourself to make a mindful decision. You mustn’t forget that people are not revealing their smart investing habits or about how under debt they are. Therefore, it’s best to work with whatever you have.

Matheus Bertelli/Unsplash | The next time a social media post makes you agitated, remind yourself of the good things in your life

Bottom line

The next time you come across an Instagram post that makes your heart fill up with envy, catch yourself in silence, take a deep breath, and remind yourself of the goals you always wanted to achieve. Remind yourself of how grateful you are in life and also for the people who influence your life for real. Maybe then that expensive post won’t do its black magic on your mind!

More in Life Hacks

-

`

Back-to-School Season Is Here! Here’s How Families Can Save Money

Back-to-school season is here, and so is the money stress. Prices are higher, budgets are tighter, and families everywhere are trying...

September 12, 2025 -

`

This Psychology-Backed Hack Makes Parenting A Lot Easier

Here is something that sounds backwards but is 100% real. Moms with one kid often feel more tired and stressed than...

September 6, 2025 -

`

Do Students Actually Learn Anything in School?

Mindfulness is now a regular part of school life for over a million students in the U.S. It promises to help...

August 29, 2025 -

`

“The Walking Dead” Actress Kelly Mack Dies at Just 33

At only 33, actress Kelly Mack has died, leaving behind grieving fans and friends in the film community. Best known for...

August 23, 2025 -

`

How to Market Your Tech Business for Billion-Dollar Growth in Dubai

Dubai’s business scene is exploding at a rapid pace. With a tech ecosystem valued at $43 billion in 2025 and ten...

August 15, 2025 -

`

Michelle Obama’s ‘Parenting Wisdom’ Earns Her a Next Gen Award

Michelle Obama is being recognized for what millions already admire her for: keeping it real, especially when it comes to parenting....

August 10, 2025 -

`

How to Make Good Habits Stick For Long? 5 Practical Tips

Good habits can change your life, but keeping them alive is the real challenge. Many people start strong and then slowly...

August 3, 2025 -

`

How A Family Crisis Pushed Brad Pitt to Quit Drinking

Brad Pitt hit a wall in 2016. The actor, known for his cool demeanor and A-list charm, found himself in the...

July 27, 2025 -

`

This New York-Based Startup Has Cool Ways of Quitting Cigarettes, Vaping & Zyn

Quitting cigarettes, vaping, and Zyn has always felt clinical, awkward, and kind of lame. But Jones, a New York-based startup, is...

July 18, 2025

You must be logged in to post a comment Login