How to Combat the Current Stock Market Chaos

Market chaos can make even the calmest investor feel like jumping ship. Stocks fall, headlines scream, and suddenly everything feels urgent and scary. But before you start making big moves, take a breath and ask yourself a few key questions. They might just save you from making a costly mistake.

Let’s talk real. The Trump administration’s aggressive tariff games are shaking things up. These moves might be part strategy, part ego, but they are slamming into the markets hard. And you are not wrong to be worried. The chaos feels personal because it hits where it hurts: Your money.

So, now is the time to stop and think. What has changed? What do you own, and why? Let’s walk through four smart questions that can help you stay grounded when the market gets wild.

What Has Actually Changed?

Market chaos can cloud your judgment fast. Your gut says something’s wrong, but has anything really changed in the companies you own?

Say you own Apple. From April 2 to April 8 – right after Trump announced his tariff plan – the stock dropped 23%. Ouch. By that point in 2025, it was down 31% on the year. Sounds scary. But zoom out.

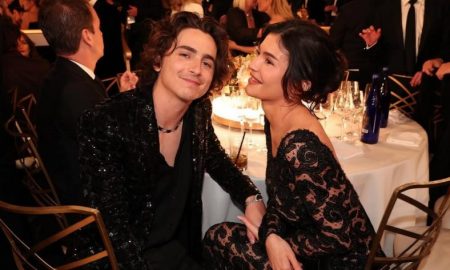

Trump / IG / Before you panic, genuinely assess what has changed with Trump’s tariffs.

If you bought Apple five years ago, you were still up 160%. If you bought it ten years ago? Over 500% gains.

The stock didn’t go bad. The business didn’t suddenly fall apart. Tariffs shook investor nerves, not company fundamentals. When panic sets in, it is easy to mistake temporary noise for a permanent problem. Don’t confuse the two.

What Do You Own and Why?

If you can’t clearly say why you own a stock or fund, ask yourself why you are even holding it. Not knowing the “why” makes it too easy to sell in a panic during market chaos.

Think of your investments like tools. You wouldn’t use a hammer to cut wood, right? Same with stocks. Some are for growth. Others for income. Some are just for balance. Know what role each one plays in your portfolio.

If something is losing value but still fits its purpose, maybe it is not time to sell. But if it no longer fits your goals, maybe it is time to rethink. Either way, know the reason behind every holding. Guesswork is a losing strategy.

Why Do You Own Stocks At All?

This might sound basic, but it is a big one. Market chaos can shake your beliefs. If stocks are making you nervous, remember why you got into them.

Anna / Pexels / Most people buy stocks to grow their money over time. Not to get rich overnight. Know your ‘why.’

The ride can be bumpy. Big drops come with big gains, but the stock market has always bounced back over the long run.

But if you realize you bought in for the wrong reasons – like chasing quick profits or following a hot tip – this might be your wake-up call. That is not investing. That is gambling. And it rarely ends well.

Are You ‘Anchoring’ to the Peak?

Behavioral economists call it anchoring, fixating on the highest price you saw and judging everything against it. That is a trap.

Let’s go back to Apple. Sure, it dropped hard after the tariffs hit. But were you planning to sell at the top? Did you even know when that was? Probably not. Most people don’t.

The pain you feel now is not always a real loss. It is regret. You are kicking yourself for not selling at the peak. But instead of focusing on that, compare the stock’s current price to what you paid. If you are still ahead, you are still winning.

More in Money

-

`

Michael Jackson’s Biopic is Filled With “Full-Blown Lies,” Daughter Paris Jackson Says

Michael Jackson’s daughter, Paris Jackson, is calling out the upcoming biopic “Michael” for what she says it really is – “full-blown...

September 20, 2025 -

`

Back-to-School Season Is Here! Here’s How Families Can Save Money

Back-to-school season is here, and so is the money stress. Prices are higher, budgets are tighter, and families everywhere are trying...

September 12, 2025 -

`

This Psychology-Backed Hack Makes Parenting A Lot Easier

Here is something that sounds backwards but is 100% real. Moms with one kid often feel more tired and stressed than...

September 6, 2025 -

`

Do Students Actually Learn Anything in School?

Mindfulness is now a regular part of school life for over a million students in the U.S. It promises to help...

August 29, 2025 -

`

“The Walking Dead” Actress Kelly Mack Dies at Just 33

At only 33, actress Kelly Mack has died, leaving behind grieving fans and friends in the film community. Best known for...

August 23, 2025 -

`

How to Market Your Tech Business for Billion-Dollar Growth in Dubai

Dubai’s business scene is exploding at a rapid pace. With a tech ecosystem valued at $43 billion in 2025 and ten...

August 15, 2025 -

`

Michelle Obama’s ‘Parenting Wisdom’ Earns Her a Next Gen Award

Michelle Obama is being recognized for what millions already admire her for: keeping it real, especially when it comes to parenting....

August 10, 2025 -

`

How to Make Good Habits Stick For Long? 5 Practical Tips

Good habits can change your life, but keeping them alive is the real challenge. Many people start strong and then slowly...

August 3, 2025 -

`

How A Family Crisis Pushed Brad Pitt to Quit Drinking

Brad Pitt hit a wall in 2016. The actor, known for his cool demeanor and A-list charm, found himself in the...

July 27, 2025

You must be logged in to post a comment Login